An IPO, or Initial Public Offering, is the process by which a private company offers its shares to the public for the first time. This marks the transition from being a privately held entity to a publicly traded company on a stock exchange.

Companies go public primarily to raise capital. This capital can be used for various purposes, such as expanding operations, funding new projects, paying off debt or providing liquidity for existing shareholders.

Recently Pakistan’s Largest electrical cable & conductor manufacturer – Fast Cables Limited (FCL) set it’s initial Public Offering (IPO) via book building from 15th-16th May’24 with an offer size of 128mn shares or 20.4% of post issue paid up capital at a floor price of PKR23.5/share. The IPO proceeds will be utilized for capacity expansion of base inputs such as plants, machinery, land etc, as capacity utilization current stands at 70%+.

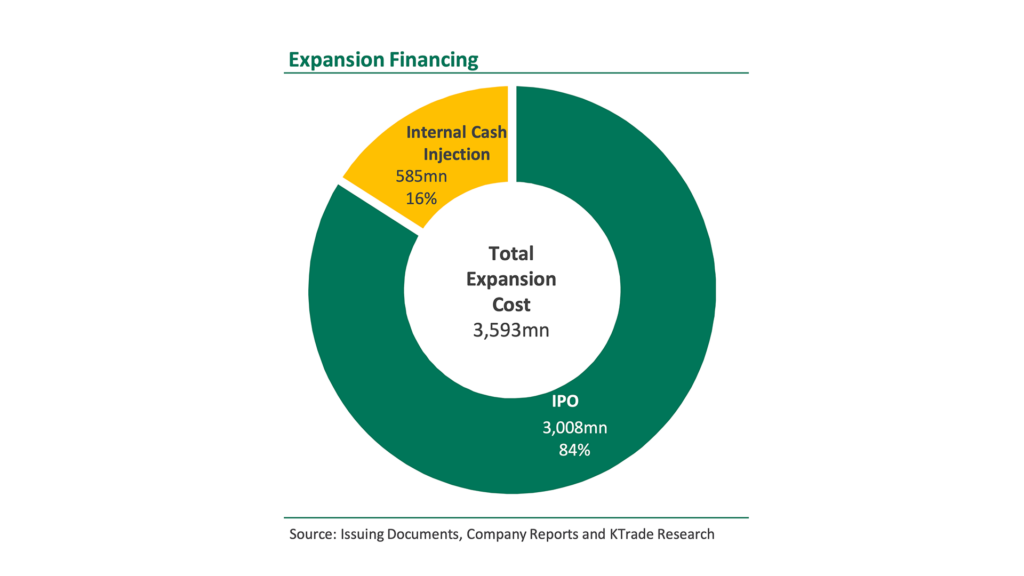

Fast Cables total expansion cost is 3,593. For which the company plans to inject internal cash of 585mn making 16% of the contribution whereas the remainder cost of 3,008mn will be covered by the IPO itself making it 84% of the contribution.

On the 16th of May, the company successfully closed the bid volume of 160 million against the offer volume of 128 million via institutional investors.