Stock Investment For Everyone

Lowest commission investing in pakistan stock exchange, plus research portal and dedicated equity trader to help you get started with KTrade. Sign up for a free account today and build your portfolio as low as Rs.2000.

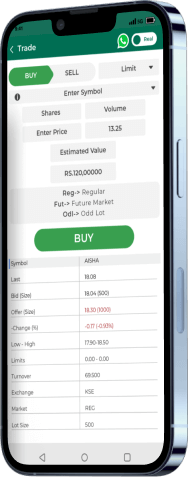

WE ARE AVAILABLE ON YOUR DEVICES

Stock Investment For Everyone

Lowest commission investing in Pakistan stock exchange, plus research portal and dedicated equity trader to help you get started with KTrade. Sign up for a free account today.

WE ARE AVAILABLE ON YOUR DEVICES

Achieve your goals by making smarter financial decisions early on.

Achieve your goals by making smarter financial decisions early on.

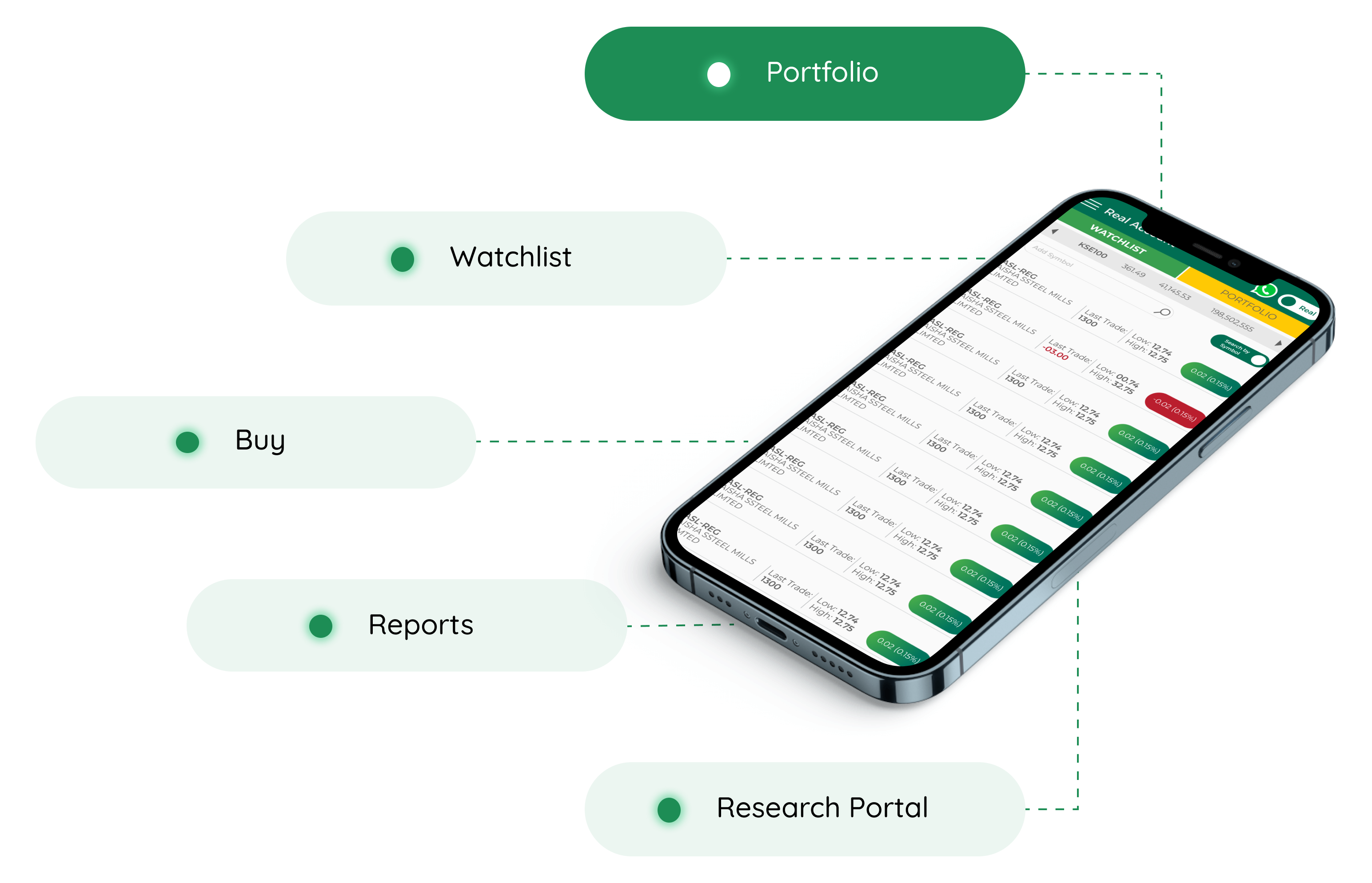

Benefits of Stock Trading with KTrade

FREE ACCOUNT OPEN

We help you open your account free of cost

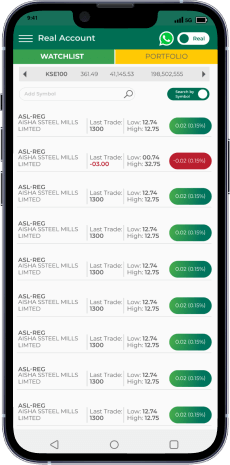

MANAGE YOUR PORTFOLIO

Easily monitor your portfolio with the KTrade App

LOWEST COMMISION

At the lowest commission within the industry

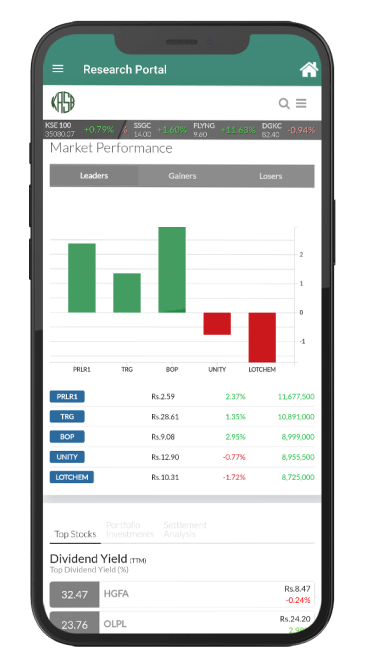

ACCESS TO RESEARCH PORTAL

Get Companies’ information at your finger tips

DEDICATED TRADERS ASSISTANCE

Get advice from our trained professionals

FAST, FRIENDLY SUPPORT

We are always here to help you

Get High Return on Investment.

Empower yourself by ensuring high profitability on your initial capital. KTrade provides investors with a safe channel to reap long term benefits.

Investor Education

KTrade aims to educate an investor to help them make well-informed decisions. Watch numerous educational videos on KTrade’s official Youtube channel or sign up for an educational course with KTrade’s KASB Varsity Course

Your Trusted Stock Broker in Pakistan

REGISTERED WITH PSX

TREC HOLDER NO. 248

REGISTERED BROKER

WITH PMEX

COMPLIANT WITH

ALL REGULATORS

100% DATA SECURITY

ENSURED

Blogs

Top Economic Events To Watch | April 15 – April 19 – 2024

Stock markets ended a tumultuous week with a decline on Friday, dragged down by disappointing earnings from major US banks,....

Read MoreKASB KTrade Economic Insights – Future trend of the US Dollar and global currency flows – April 2024

The rise of the global South, the strengthening of platforms such as BRICS, and the record-high price of Gold, are....

Read MoreNAGA Weekly Recap April 1 – 2024 – April 5 – 2024

This week in the markets, we’ve seen a whirlwind of activity that’s sure to catch the attention of traders and....

Read MoreYoutube Channel

Learn from experts. Save, Trade and Invest in stocks through KTrade app

Our experts are always available to guide you regarding the best of investments.

Get in Touch with us

OUR OFFICES

021-35248975 | 021-35248973 | UAN:021-111-115-272

Pakistan Stock Exchange Office

Room 101, 105, 108, 109 & 110 New Building Pakistan Stock

Exchange, Stock Exchange Road, Karachi.

021-32410918 | 021-32431435 | 021-32461584

Multan Office

Plot No. 84/2, Bomanji Square, Nusrat Road, Bomanji

Chowk, Multan

061-4540347-49

See more Locations

Get in Touch with us

OUR OFFICES

Corporate Office

Office No. 101 & 102 Located on 1st Floor, Plot No.33-C,

Bukhari Commercial Lane 13, Phase-VI, DHA, KARACHI

UAN:021-111-115-272

Pakistan Stock Exchange Office

Room 101, 105, 108, 109 & 110 New Building Pakistan Stock

Exchange, Stock Exchange Road, Karachi.

021-35340499 | 021-35241092

Multan Office

Plot No. 84/2, Bomanji Square, Nusrat Road, Bomanji

Chowk, Multan

061-4540347-49

See more Locations